Get the most up-to-date data and insights into shipping volumes and the cost of freight. See how they change each month and understand the market forces behind them.

| June 2023 | Year-over-year change | 2-year stacked change | Month-to-month change | Month-to-month change (SA*) | |

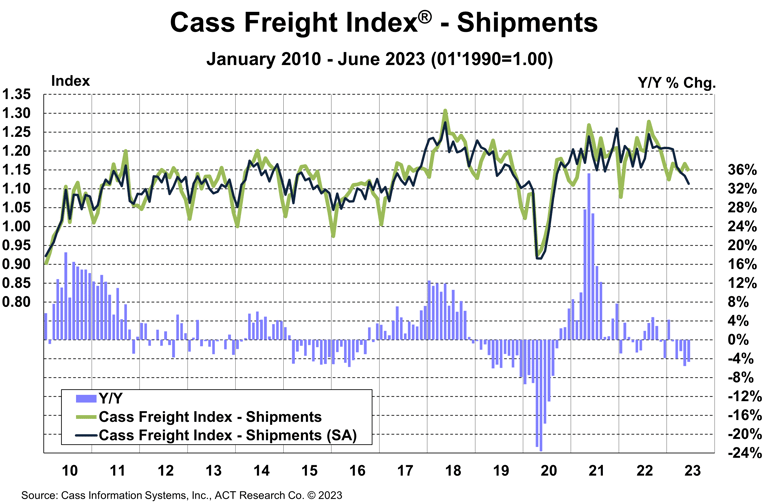

| Cass Freight Index - Shipments | 1.147 | -4.7% | -6.8% | -1.6% | -1.9% |

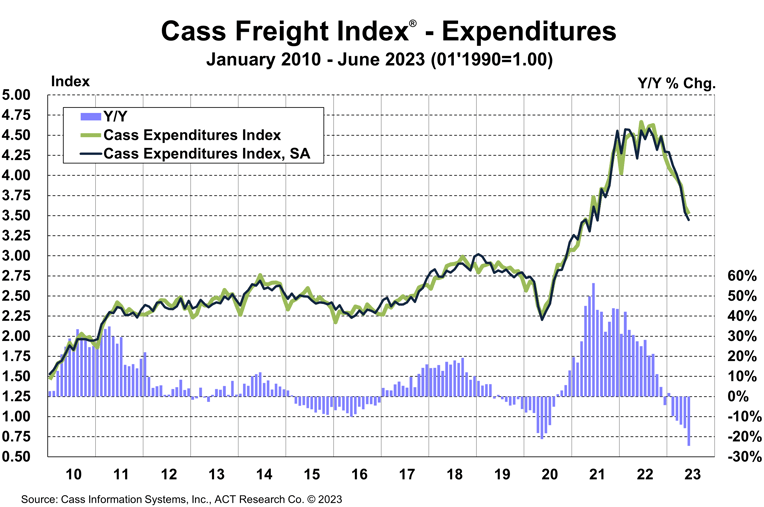

| Cass Freight Index - Expenditures | 3.520 | -24.5% | -5.7% | -2.6% | -2.8% |

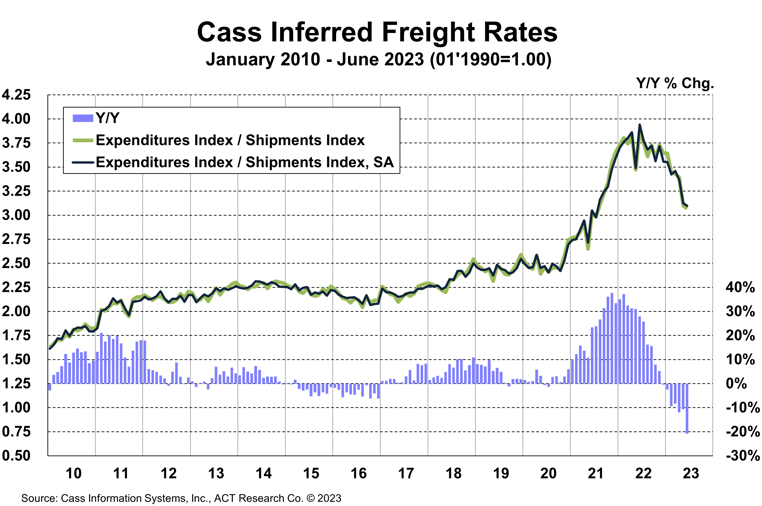

| Cass Inferred Freight Rates | 3.069 | -20.9% | NA | -1.0% | -0.9% |

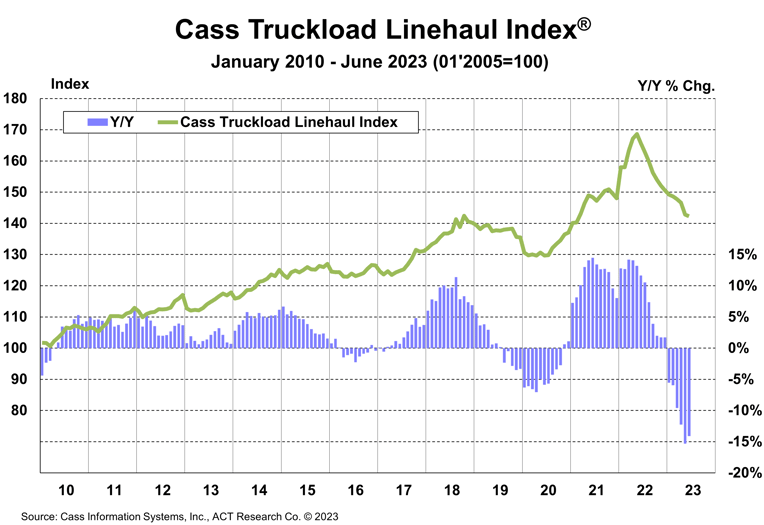

| Truckload Linehaul Index | 142.3 | -14.1% | -4.1% | -0.4% | -- |

* SA = seasonally adjusted

The shipments component of the Cass Freight Index® fell 1.6% m/m in June and fell 1.9% m/m in seasonally adjusted (SA) terms.

In seasonally adjusted terms, the index is now 12% below the December 2021 cycle peak, slightly greater than the peak-to-trough declines in two of the three downcycles in the past dozen years.

With normal seasonality, this index would fall slightly m/m in July and decline about 6% y/y.

See the Methodology for the Cass Freight Index

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 2.6% m/m and 24.5% y/y in June.

With shipments down 1.6% m/m in June (compared to a decline in total spending of 2.6%), we infer rates were down 1.0% m/m (see our inferred rates data series below).

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges, so is a bit more volatile than the cleaner Cass Truckload Linehaul Index®.

The expenditures component of the Cass Freight Index rose 23% in 2022, after a record 38% increase in 2021, but is set to decline about 17% in 2023, assuming normal seasonal patterns from here. With both freight volume and rates under pressure at this point in the cycle, that assumption is likely optimistic, so we may be looking at a ~20% decline in freight spending this year.

The rates embedded in the two components of the Cass Freight Index declined 21% y/y in June, after falling 11% in May.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload (TL) representing more than half of the dollars, followed by less-than-truckload (LTL), rail, parcel, and so on.

The Cass Truckload Linehaul Index, which measures the per-mile change in linehaul rates, fell 0.4% m/m in June to 142.3, after a 2.6% m/m decline in May.

See the Methodology for the Cass Truckload Linehaul Index

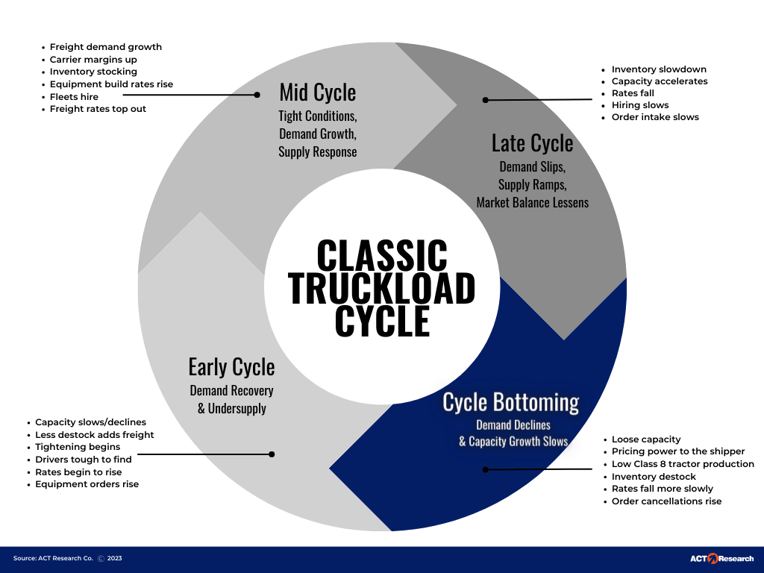

The volume downturn appears to be in the later innings, and after a long soft patch, we see the U.S. freight transportation industry on the cusp of a new cycle. We characterize this phase of the cycle as the bottoming phase.

One key ingredient of the bottoming phase, which is absent so far this cycle, is lower equipment production. As Class 8 build rates remain elevated, pressure remains on fleets to seat these tractors.

Our fleet friends suggest that some of the recent strength in Bureau of Labor Statistics (BLS) employment data is owner-operators moving back to for-hire jobs.

Thus, the BLS trucking jobs data likely overstates industry employment trends but has been resilient nonetheless, leading to fewer hours worked. In the months to come, rebalancing will continue, but this dynamic threatens to prolong the bottoming process.

For more on the future direction of freight markets, the ACT Research Freight Forecast provides analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type. The service provides monthly, quarterly, and annual predictions for the TL, LTL, and intermodal markets over a two- to three-year time horizon, including capacity, volumes, and rates. The Freight Forecast is released monthly in conjunction with this report.

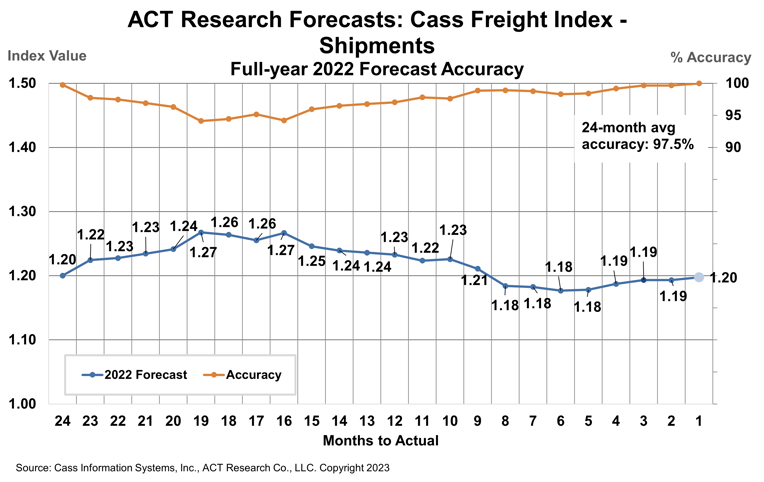

How have their forecasts performed? For 2022, ACT’s forecasts for the shipments component of the Cass Freight Index were 97.5% accurate on average for the 24-month forecast period. Our January 2021 forecast, two full years out, was 99.8% accurate.

(As a reminder, ACT Research’s Tim Denoyer writes this report.)

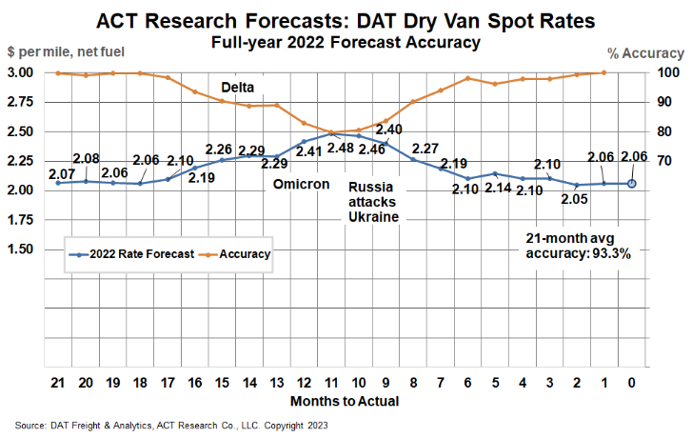

ACT Research’s full-year 2022 DAT spot rate forecasts were 99.7% accurate from Q2’21 (19-21 months out) for dry van and 98.5% for reefer. DAT dry van spot rates, net fuel, finished 2022 at $2.06 per mile, in line with our forecasts to the penny from 18 and 19 months out (June and July 2021).

Release date: We strive to release our indexes on the 13th of each month. When this falls on a Friday or weekend, our goal is to publish on the next business day.

Tim Denoyer joined ACT Research in 2017 after spending fifteen years in equity research focused primarily on the transportation, machinery, and automotive industries. Tim is a senior analyst leading ACT’s transportation research effort and the primary author of the ACT Freight Forecast, U.S. Rate and Volume OUTLOOK. Research associate, Carter Vieth, who joined ACT in early 2020 after graduating from Indiana University, also contributes to the report. This report provides supply-chain professionals with better visibility on the future of pricing and volume in trucking, the core of the $1.2 trillion US freight transportation industry, including TL, LTL, and intermodal.

Tim also contributes to ACT’s core Classes 4-8 commercial vehicle (CV) data analysis and forecasting; powertrain development, such as electrification analysis; and used truck valuation and forecasting. Tim has supported or led numerous project-based market studies on behalf of clients in his six years with ACT on topics ranging from upcoming emissions and environmental regulations to alternative powertrain cost analyses, to e-commerce and last-mile logistics, to autonomous freight market sizing.

ACT’s freight research service leverages its expertise in the supply-side economics of transportation and draws upon Tim’s background as an investment analyst, beginning at Prudential and Bear Stearns. Tim was a co-founder of Wolfe Research, one of the leading equity research firms in the investment industry. His experience also includes responsibility for covering the industrial sector of the global equity markets, including with leading investment management company Balyasny Asset Management.

The material contained herein is intended as general industry commentary. The Cass Freight Index, Cass Truckload Linehaul Index (“Indexes”), and other content are based upon information that we consider reliable, but Cass does not guarantee the accuracy, timeliness, reliability, continued availability or completeness of any information or underlying assumptions, and Cass shall have no liability for any errors, omissions or interruptions. Any data on past performance contained in the Indexes is no guarantee as to future performance. The Indexes and other content are not intended to predict actual results, and no assurances are given with respect thereto. Cass makes no warranty, express or implied. Opinions expressed herein as to the Indexes are those of ACT Research and may differ from those of Cass Information Systems Inc. All opinions and estimates are given as of the date hereof and are subject to change.

© Copyright 2023 Cass Information Systems, Inc.