Get the most up-to-date data and insights into shipping volumes and the cost of freight. See how they change each month and understand the market forces behind them.

| July 2023 | Year-over-year change | 2-year stacked change | Month-to-month change | Month-to-month change (SA*) | |

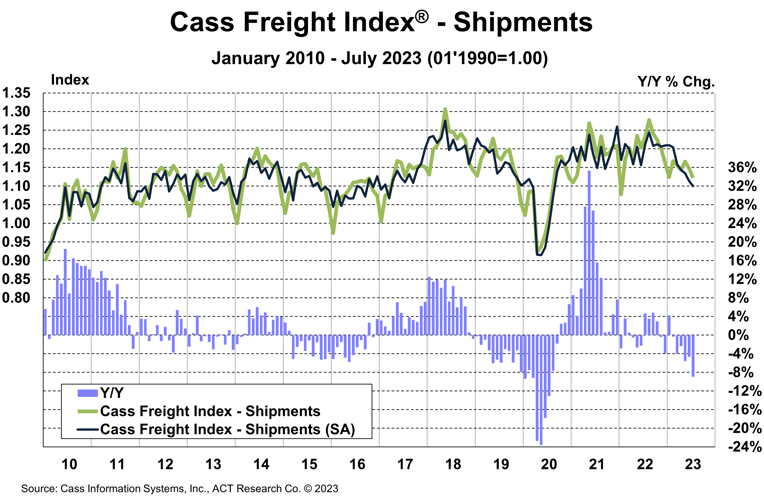

| Cass Freight Index - Shipments | 1.122 | -8.9% | -4.7% | -2.2% | -1.2% |

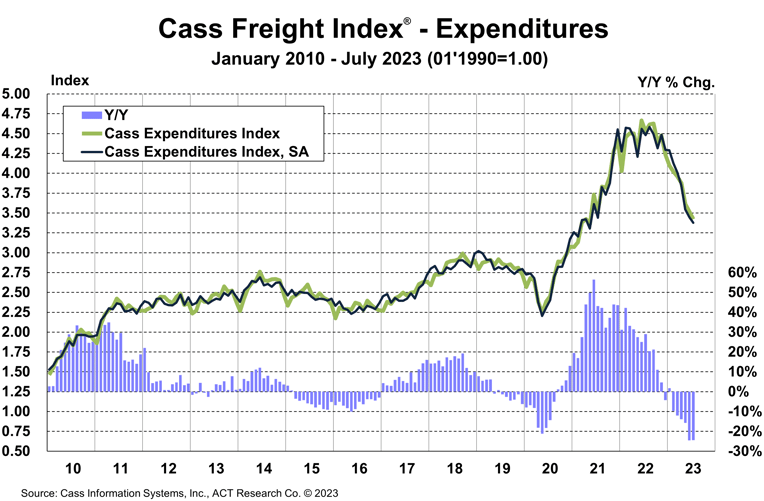

| Cass Freight Index - Expenditures | 3.423 | -24.4% | -2.5% | -2.8% | -2.0% |

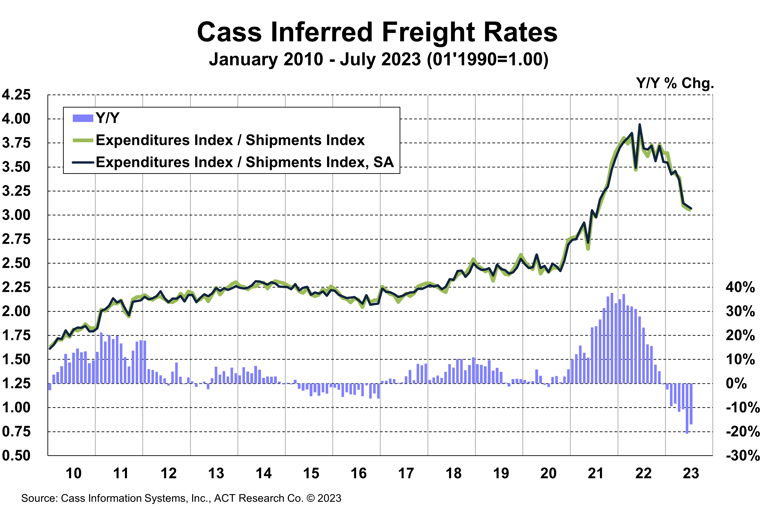

| Cass Inferred Freight Rates | 3.051 | -17.0% | NA | -0.6% | -0.8% |

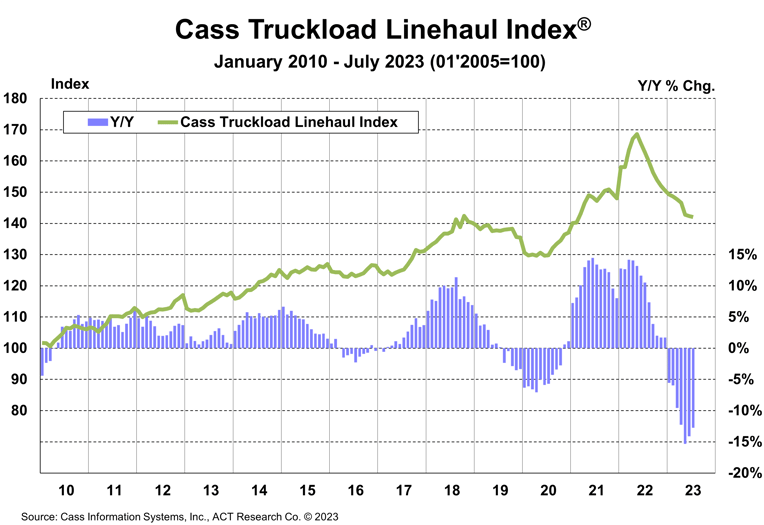

| Truckload Linehaul Index | 142.0 | -12.7% | -3.5% | -0.2% | -- |

* SA = seasonally adjusted

The shipments component of the Cass Freight Index® fell 2.2% m/m in July and fell 1.2% m/m in SA terms.

In seasonally adjusted (SA) terms, the index is now 13% below the December 2021 cycle peak, slightly greater than the peak-to-trough declines in two of the three downcycles in the past dozen years.

With normal seasonality, this index would increase slightly m/m in August but decline about 11% y/y, comparing to the extraordinary time last summer when destocking was actually creating freight demand as retailers were shipping out stale inventory. Even adjusting for the strange comparison, this will probably overstate the pressure on national freight volumes because the for-hire market is losing share to private fleets, as discussed below.

See the Methodology for the Cass Freight Index

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 2.8% m/m and 24.4% y/y in July.

With shipments down 2.2% m/m in July, we infer rates were down 0.6% m/m (see our inferred rates data series below).

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges, so is a bit more volatile than the cleaner Cass Truckload Linehaul Index®.

The expenditures component of the Cass Freight Index rose 23% in 2022, after a record 38% increase in 2021, but is set to decline about 18% in 2023, assuming normal seasonal patterns from here. Both freight volume and rates remain under pressure at this point in the cycle, but fuel price increases could limit the savings for shippers.

The rates embedded in the two components of the Cass Freight Index declined 17% y/y in July, after falling 21% in June.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload (TL) representing more than half of the dollars, followed by less-than-truckload (LTL), rail, parcel, and so on.

The Cass Truckload Linehaul Index, which—as its name implies—measures changes in linehaul rates only, fell 0.2% m/m in July to 142.0, after a 0.4% m/m decline in June.

See the Methodology for the Cass Truckload Linehaul Index

We’ve been citing the key factors behind the freight downturn—substitution and inventory—for well over a year, but it’s not all macro factors.

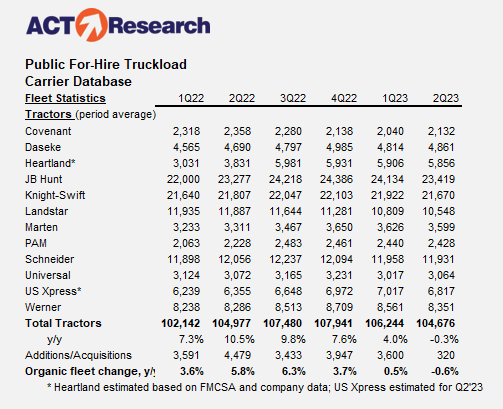

One key and likely underappreciated industry-specific factor is the rapid growth of private fleets. The publicly traded for-hire truckload fleets reduced their collective tractor count by 3% in 1H’23 (see table) and operating authority revocations remain elevated, so for-hire capacity is contracting quickly. But Class 8 tractor production is still at maximum levels, growing the overall fleet, and consequently keeping downward pressure on spot rates.

Private fleets represent over half of Class 8 tractor capacity, and we believe their growth is pulling freight out of the for-hire market, prolonging the industry downturn.

Though significant progress has been made in rebalancing, we think it’s unlikely that industry capacity will broadly tighten until pressure from private fleet growth eases, which looks unlikely this year. Though the freight market is still near the bottom of the cycle, the first step in getting out of a hole is to stop digging. New truck orders in the next few months will be very interesting and, in our view, will be pivotal to setting the market tone for 2024.

The capacity contraction in the for-hire sector is coiling the proverbial spring for better market conditions, but this outlook could be spoiled if the private fleet segment continues its massive fleet expansion.

If you need to understand the future direction of freight markets, the ACT Research Freight Forecast provides in-depth analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type, LTL and intermodal price indexes. This service provides monthly, quarterly, and annual predictions for the TL, LTL, and intermodal markets over a two- to three-year time horizon, including capacity, volumes, and rates. The Freight Forecast is released monthly in conjunction with this report.

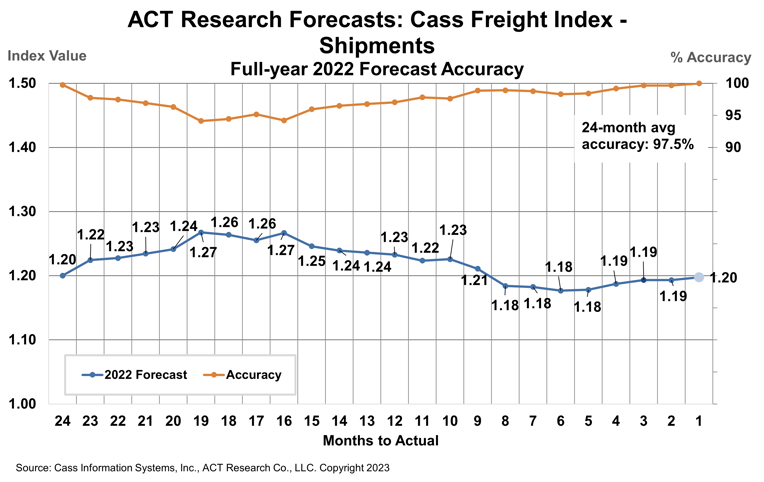

How have their forecasts performed? For 2022, ACT’s forecasts for the shipments component of the Cass Freight Index were 97.5% accurate on average for the 24-month forecast period. Our January 2021 forecast, two full years out, was 99.8% accurate.

(As a reminder, ACT Research’s Tim Denoyer writes this report.)

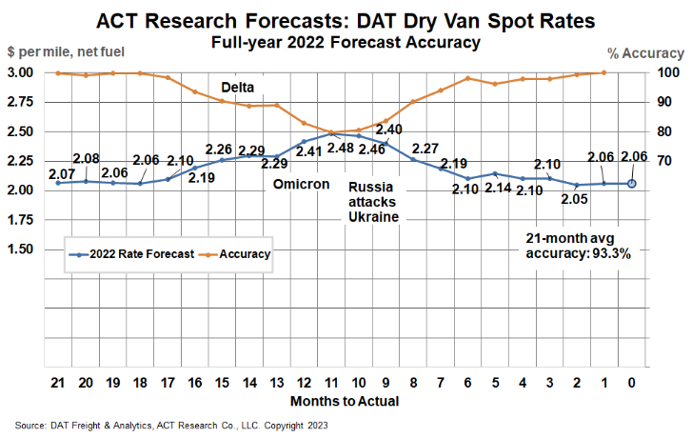

ACT Research’s full-year 2022 DAT spot rate forecasts were 99.7% accurate from Q2’21 (19-21 months out) for dry van and 98.5% for reefer. DAT dry van spot rates, net fuel, finished 2022 at $2.06 per mile, in line with our forecasts to the penny from 18 and 19 months out (June and July 2021).

Release date: We strive to release our indexes on the 13th of each month. When this falls on a Friday or weekend, our goal is to publish on the next business day.

Tim Denoyer joined ACT Research in 2017 after spending fifteen years in equity research focused primarily on the transportation, machinery, and automotive industries. Tim is a senior analyst leading ACT’s transportation research effort and the primary author of the ACT Freight Forecast, U.S. Rate and Volume OUTLOOK. Research associate, Carter Vieth, who joined ACT in early 2020 after graduating from Indiana University, also contributes to the report. This report provides supply-chain professionals with better visibility on the future of pricing and volume in trucking, the core of the $1.2 trillion US freight transportation industry, including TL, LTL, and intermodal.

Tim also contributes to ACT’s core Classes 4-8 commercial vehicle (CV) data analysis and forecasting; powertrain development, such as electrification analysis; and used truck valuation and forecasting. Tim has supported or led numerous project-based market studies on behalf of clients in his six years with ACT on topics ranging from upcoming emissions and environmental regulations to alternative powertrain cost analyses, to e-commerce and last-mile logistics, to autonomous freight market sizing.

ACT’s freight research service leverages its expertise in the supply-side economics of transportation and draws upon Tim’s background as an investment analyst, beginning at Prudential and Bear Stearns. Tim was a co-founder of Wolfe Research, one of the leading equity research firms in the investment industry. His experience also includes responsibility for covering the industrial sector of the global equity markets, including with leading investment management company Balyasny Asset Management.

The material contained herein is intended as general industry commentary. The Cass Freight Index, Cass Truckload Linehaul Index (“Indexes”), and other content are based upon information that we consider reliable, but Cass does not guarantee the accuracy, timeliness, reliability, continued availability or completeness of any information or underlying assumptions, and Cass shall have no liability for any errors, omissions or interruptions. Any data on past performance contained in the Indexes is no guarantee as to future performance. The Indexes and other content are not intended to predict actual results, and no assurances are given with respect thereto. Cass makes no warranty, express or implied. Opinions expressed herein as to the Indexes are those of ACT Research and may differ from those of Cass Information Systems Inc. All opinions and estimates are given as of the date hereof and are subject to change.

© Copyright 2023 Cass Information Systems, Inc.