Topics: Cash Flow Management

In the transportation industry, keeping the wheels turning and revenue flowing means navigating the financial roadblocks trying to slow your growth journey. What if you could navigate these challenges with the finesse of an experienced driver flawlessly backing into a loading dock? This article will equip you with practical know-how to reduce expenses, increase operating efficiencies, and, ultimately, pave the way for mastering cash flow.

Your Roadmap to Improving Cash Flow

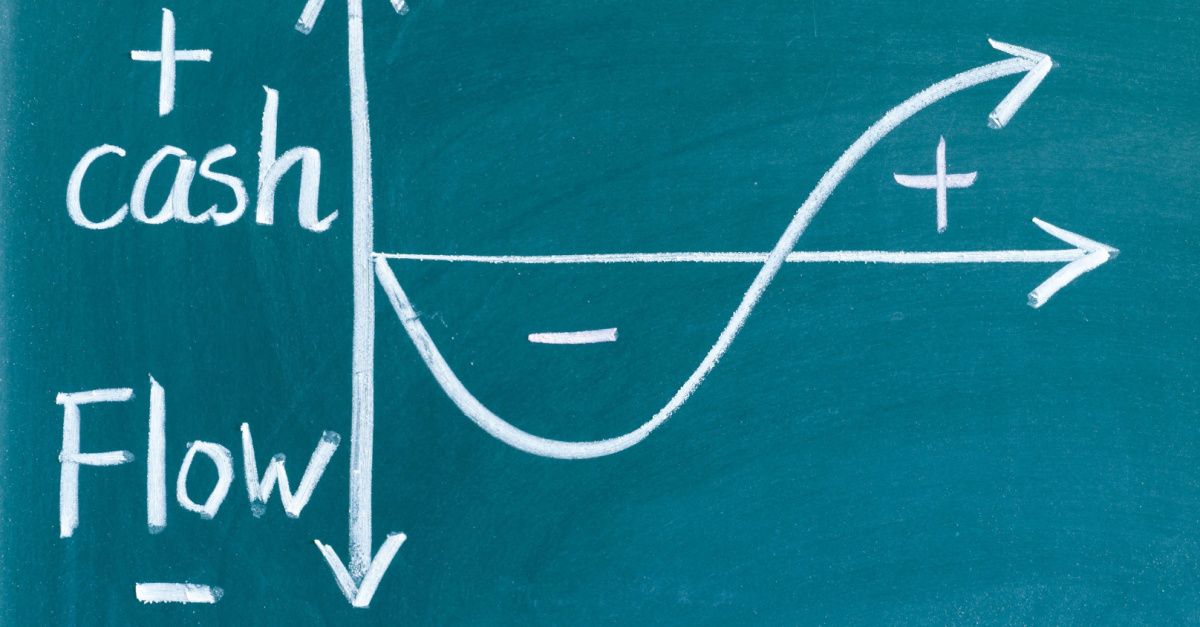

Cash flow management sits at the core of transporting freight. It affects every aspect of operations, from fuel consumption to labor. Implementing tried and true cash flow strategies can significantly drive down your operational expenses and maximize profitability.

1. Fuel Efficiency - Strategies for a Leaner Operation

Fuel is the lifeblood of any trucking operation. With the national diesel price at $3.473 per gallon, there's no room for wasteful practices. So, how can you cut back?

- Employ route optimization to minimize distances traveled, thereby reducing fuel consumption.

- Schedule regular vehicle maintenance checks to ensure your trucks are operating at optimal fuel efficiency.

- Conduct driver training programs to instill fuel-efficient driving practices and reduce idling, which could make a significant difference over the long haul.

2. Preventive Maintenance - The Cornerstone of Longevity

You will save more by preventing a problem than by fixing it. Preventative maintenance helps avoid costly breakdowns, extends the lifespan of your vehicles, and reduces downtime.

- Don't wait for the smell of burning oil or the sight of dark exhaust. Instead, adhere to a strict schedule for oil changes.

- Perform tire rotations and maintain proper tire pressure to extend the life of your tires.

- Make brake inspections a part of your regular vehicle check-up to prevent catastrophic failures.

3. Outsourcing Non-Core Activities - The Strategic Lever

You can't be a jack of all trades, nor should you be. Outsourcing non-core activities frees up resources and allows you to focus on what you do best. Outsourcing offers cost savings by avoiding the overhead associated with in-house operations and provides access to specialized skills and expertise.

- Consider outsourcing accounting to keep your books in pristine condition.

- Employ third-party logistics planning to ensure optimal routing and delivery schedules.

- Bring in specialized IT services to keep your tech infrastructure up and running without a hitch.

4. Negotiating Better Contracts - Setting the Foundation for Prosperity

A well-negotiated contract can make a significant difference to your bottom line. So, how can you make sure you're on the winning side?

- Investigate market rates thoroughly to ensure you are getting fair compensation.

- Clearly define the scope of work to avoid misunderstandings and unplanned expenses.

- Always maintain a willingness to find middle ground. Flexibility can be a great asset in long-term partnerships.

5. Diversifying Client Base - Shielding Against Market Instability

Putting all your eggs in one basket is risky, especially in an industry as volatile as freight transportation. Diversifying your client base shields you against market fluctuations and opens doors to new opportunities. How can you achieve this?

- Perform market research to identify new sectors and niches that align with your core competencies.

- Build relationships through networking events, partnerships, and client referrals.

- Expand your service offerings to cater to different markets and attract a broader clientele.

6. Telematics and Fleet Management Systems - The Future of Fleet Oversight

From real-time tracking to route planning, these technologies provide actionable insights that can save time and money.

To choose the right system for your business:

- Understand your specific needs and requirements to match them with appropriate features.

- Compare different systems' functionality and scalability to ensure they meet your growth goals.

- Opt for customizable solutions whenever possible to allow for future updates and specialized applications.

7. Automated Billing and Invoicing - The Pathway to Prompt Payments

Managing bills and invoices is one of the most tedious aspects of freight transportation. Automation in this sector ensures timely payments, reduces the administrative burden, and enhances billing accuracy.

- Start by evaluating your billing processes to identify areas where automation can provide quick wins.

- Select suitable automation software, considering ease of use, integrations, and reliability.

- Once implemented, provide adequate training to relevant staff to ensure a smooth transition and optimal utilization of the new system.

8. Opting for Quick Pay Programs - Your Financial Lifeboat

Cash flow can become a significant roadblock, with payment terms stretching to 60, 90, or even 120 days. Opting for quick pay programs can be the solution you need to solve the cash flow conundrum.

- Quick payment programs like accelerate cash flow, enabling swift fulfillment of financial obligations.

- These programs streamline payment processes, saving time that can be reinvested in business growth.

- Adopting quick payment solutions demonstrates savvy cash flow management, enhancing a company's market position.

By including quick payment solutions as part of your financial strategy, you alleviate immediate cash flow issues and set the stage for long-term financial health and growth.

9. Maintaining a Cash Reserve - The Financial Buffer You Need

A cash reserve acts as your financial buffer, aiding in emergency preparedness, ensuring long-term stability, and providing the flexibility to seize new opportunities. But how does one go about building this reserve?

- Allocate a fixed percentage of your revenue to a savings account regularly. Make this as routine as fueling your trucks.

- Identify and eliminate expenses that do not contribute to your core activities. Channel freed up funds into your cash reserve.

- Formulate and strictly follow budgets that account for savings, ensuring that a cash reserve is integral to your financial planning.

10. Efficient Invoice Processing - Your Route to Financial Consistency

Effective invoice processing becomes the backbone of cash flow in an industry where payments often stretch across long terms. It's not just about receiving payments but about maintaining a cadence that helps sustain healthy customer relationships.

- Utilize software solutions that streamline the invoicing process, making it efficient and less prone to errors.

- Establish a system for following up on overdue payments, ensuring you have a steady stream of incoming cash.

- Set and communicate transparent payment terms from the get-go.

Mastering Cash Flow with Cass

From fuel efficiency to diversified client bases, these strategies provide a roadmap to success. The journey doesn't end there; consider leveraging specialized solutions tailored to your unique needs to unlock your business's true potential. Cass's Quick Payment solutions, backed by over three decades of expertise and a remarkable $90 billion paid out in 2022, offer a groundbreaking approach to improving cash flow. With the ability to receive lump-sum payments just two days after invoice approval, you enhance cash flow, open doors toward growth, reduce stress and improve operational focus.

Why wait? Seize this opportunity to experience the transformative power of Cass's Quick Payment solutions firsthand. Elevate your cash flow, expand your business reach, and redefine what success means for your business today. The road to financial prosperity begins with your next strategic decision.