Topics: Ocean shipping, Invoice Auditing

It should be no surprise that freight invoices for international shipments are complicated. Pressure on carriers to reduce base freight rates over the years has led to a proliferation of add-ons, surcharges, and accessorials. This is particularly true for international air and ocean shipments.

Behind this complexity is more than a hundred ocean transportation surcharges assigned to freight invoices over a myriad of trade lanes worldwide. It’s important to identify and audit surcharges and accessorials to minimize costly overcharges and to aid in future freight contract negotiations.

Further adding to invoice and freight cost complexity is the carrier’s need to hedge against potential losses due to exchange rate fluctuations that occur between the contract date and the ship, receipt, or invoice date. Historically, this risk has most commonly been managed with a surcharge called currency adjustment factor or CAF. The currency adjustment factor is a fixed percent exchange rate differential applied to cross-currency invoices.

There are no universal best practices for managing exchange rate fluctuations. While using a CAF is most common, other options should be evaluated.

Large volume shippers can potentially accumulate hundreds of thousands of dollars in exchange rate adjustments or surcharges annually so it’s important to choose the method you deem most financially advantageous while also maintaining the ability to capture, audit, and categorize the data for analysis.

3 Strategies for Managing CAF & Freight Invoice Currency Conversions

1. Currency Adjustment Factor (CAF)

CAF has been the most popular method for carriers to mitigate currency conversion risks. With this methodology, a flat percentage surcharge is applied to freight invoices based on long-term international freight contracts. For example, a CAF for shipments from Japan to the U.S. might be 10%. This means the shipper will incur a 10% surcharge on every Japan-to-U.S. shipment for the life of the contract, regardless of which way the exchange rate moves. The CAF you pay may vary from one currency to the next and one service provider to the next.

The main advantages for the shipper are surcharge visibility and auditability.

A typical CAF surcharge for ocean or air freight invoices is calculated as follows:

|

Freight charge |

$2,000 |

|

Surcharges & accessorials |

350 |

|

10% CAF surcharge (10% of $2,350) |

235 |

|

Adjusted Freight Charge |

$2,585 |

A 10% CAF not only increases the base rate but also increases the cost of each surcharge line item of the invoice. As with all freight extras, its important to understand the implications of CAF surcharges on transportation cost structures and contract negotiations.

2. Build into Rates

Some shippers have chosen to bulk up their base rate to account for currency fluctuations in each trade lane. Instead of paying $2,300 for a container charge, for example, they might pay $2,450. Shippers are primarily looking for freight cost certainty with this methodology rather than having to deal with a CAF or exchange rate volatility throughout the contract.

There are downsides to building the cost into your rates. The primary disadvantage is the lack of visibility to your actual costs for currency fluctuations. Because the cost is hidden, it becomes difficult to determine later if using this methodology was the best decision financial decision. Additionally, as with the CAF, the shipper pays the inflated rate regardless of which way the exchange rate moves.

3. Use Daily Market-Based Exchange Rates

Some large shippers and carriers are managing exchange rate volatility by applying the actual exchange rate on the ship, receipt, or invoice date. With this method, ocean and air freight costs can change frequently. However, it’s the most accurate way to compensate carriers and forwarders while providing accurate freight cost data to shippers. Another important difference from the previous two methods is that this option allows for costs to decrease (shippers pay more when their currency decreases but less when it increases). With the first two options, the shipper always pays more.

This methodology applies the daily interbank rate as published by an authoritative exchange rate source, such as the Wall Street Journal or Oanda, to the freight invoice based on either the ship, receipt, or invoice date. With this method, the cost to the shipper increases as the U.S. Dollar decreases.

Need for Standardized Global Freight Exchange Rates

Exchange rate charges or adjustments aren’t always a freight contract line item although many shippers are insisting that standardized global exchange rate language be included in future negotiations. Standardized language won’t necessarily result in immediate exchange rate savings, but it does make the charge auditable and therefore subject to dispute.

Cass director of audit and rating services Don Pesek advocated for standardized global exchange rates in a 2016 Journal of Commerce interview stating, “a standardized approach would also improve accuracy in currency conversions, which are another cause of errors. When the carrier’s invoice is in one currency and the shipper’s standard practice is to pay in another, each often uses a different currency conversion source to calculate the amount owed — and the result is a discrepancy in the two estimates, and confusion.”

Standardized daily exchange rates allow shippers to accumulate near-real-time granular data on global exchange rate movements and eliminates potential freight invoice overcharges that may occur with the first two models discussed. There’s no need for hedging or padding rates to manage risk. Variable currency conversion rates offer real-world exchange gains and losses for shippers, carriers, and 3PLs.

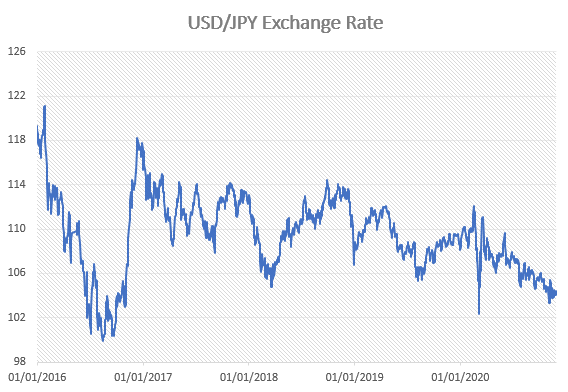

If we look at a 5-year currency valuation trend of the Japanese Yen to the U.S. dollar, it becomes clear that trying to manage that level of volatility with CAF or built-in rates may be an exercise in futility.

Data Source: https://www.macrotrends.net/2550/dollar-yen-exchange-rate-historical-chart

Negotiating Auditable Contracts

Whatever methodology is chosen, it is essential that contract language be clear so that invoice disputes are minimal. This may mean listing each trade lane, naming an authoritative source for exchange rates, and specifying which date to use for the conversion.

The issue then becomes whether your company has the digital capability to not only audit invoices but capture and analyze transportation spend at a granular level. Cass’s freight payment solution is designed to provide detailed business intelligence for your transportation spend. Logistics and financial executives as well as economic modelers can then use the data for a multitude of tasks, including in the growing field of predictive analytics for logistics management.