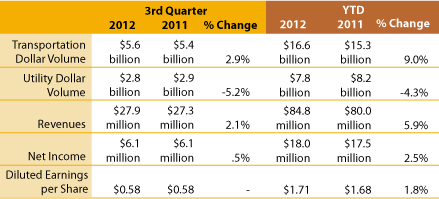

ST. LOUIS, October 18, 2012 (Business Wire) -- Cass Information Systems, Inc. (Nasdaq: CASS), the nation's leading provider of transportation, utility, telecom and environmental invoice payment and information services, reported third quarter 2012 earnings of $.58 per diluted share, matching earnings reported in the third quarter of 2011. Net income for the period was $6.1 million, identical to 2011 results.

2012 3rd Quarter Recap

Increased activity from base customers and new customers helped transportation dollar volume increase 3%. Utility dollar volume was down 5%, primarily due to lower rates for electricity and natural gas. Overall, year-to-year quarterly revenues grew 2% from $27.3 million to $27.9 million.

Net investment income decreased slightly due to the on-going decline in interest rates.

Operating expenses were up 5%, or $1.0 million, primarily due to costs related to the launch of the company’s new environmental expense service line following its acquisition of Jacksonville, Fla.-based Waste Reduction Consultants, Inc. in January.

Nine-Month 2012 Recap

For the nine-month period ended September 30, 2012, Cass earned $1.71 per diluted share, a 2% increase over the $1.68 per diluted share earned in the comparable period of 2011. Net income grew to $18.0 million, 3% higher than the $17.5 million earned in 2011. Revenues rose 6%, from $80.0 million in 2011 to $84.8 million in 2012.

Operating expenses were up 9%, or $4.8 million, with the bulk of the increase attributable to the Waste Reduction Consultants acquisition.

“While new account wins helped our transportation invoice processing operation grow volume in a tepid global economy, a dip in utility rates and historically low interest rates created a drag on earnings that produced a flat quarterly result,” commented Eric H. Brunngraber, Cass president and chief executive officer. “Just as we have endured the low-growth environments of the past by concentrating on identifying strategies that improve operating efficiency and enhance our competitive position, we are confident that Cass will resume a growth trajectory as the global economy strengthens and interest rates normalize.”

10% Stock Dividend Declared With Increase in Cash Dividend

On October 15, 2012, the company’s board of directors declared a 10% stock dividend payable December 14, 2012 to shareholders of record December 5, 2012. Shareholders will receive one additional share of Cass stock for each 10 shares owned. No fractional shares will be issued. Shareholders will receive cash for any fractional shares owned based on the share price reported by NASDAQ at the close of trading December 5, 2012.

In addition, the company’s board declared a fourth quarter cash dividend of $.18 per share payable December 14, 2012 to shareholders of record December 5, 2012. That is a one cent increase from the previous dividend per share. The upcoming cash payout will apply to all shares held after the 10% stock dividend is completed, effectively increasing the fourth quarter dividend by more than 16%. “These actions by the board reflect the company’s strong capital base, its solid performance and the board’s optimism about our future,” said Brunngraber. Cass has continuously paid regularly scheduled cash dividends since 1934.

About Cass Information Systems

Cass Information Systems is the leading provider of transportation, utility, telecom and environmental invoice payment and information services. The company, which has been involved in the payables services and information support business since 1956, disburses $32 billion annually on behalf of customers from locations in St. Louis, Mo., Columbus, Ohio, Boston, Mass., Greenville, S.C., Wellington, Kansas, and Jacksonville, Fla. The support of Cass Commercial Bank, founded in 1906, makes Cass Information Systems unique in the industry. Cass is part of the Russell 2000® Index.

Note to Investors

Certain matters set forth in this news release may contain forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially from those in such statements. For a discussion of certain factors that may cause such forward-looking statements to differ materially from the company’s actual results, see the company’s reports filed from time to time with the Securities and Exchange Commission including the company’s annual report on Form 10-K for the year ended December 31, 2011.